Search

Search

While much public attention across the U.S. has been paid to the Medicare drug price negotiation capabilities, less visible is the uncertainty that remains over drug price reporting implementation and enforcement required by the federal government’s Transparency in Coverage rule. Lack of thorough guidance from the Centers for Medicare & Medicaid Services (CMS) regarding commercial net price reporting is creating ambiguity around expected life sciences manufacturer responses.

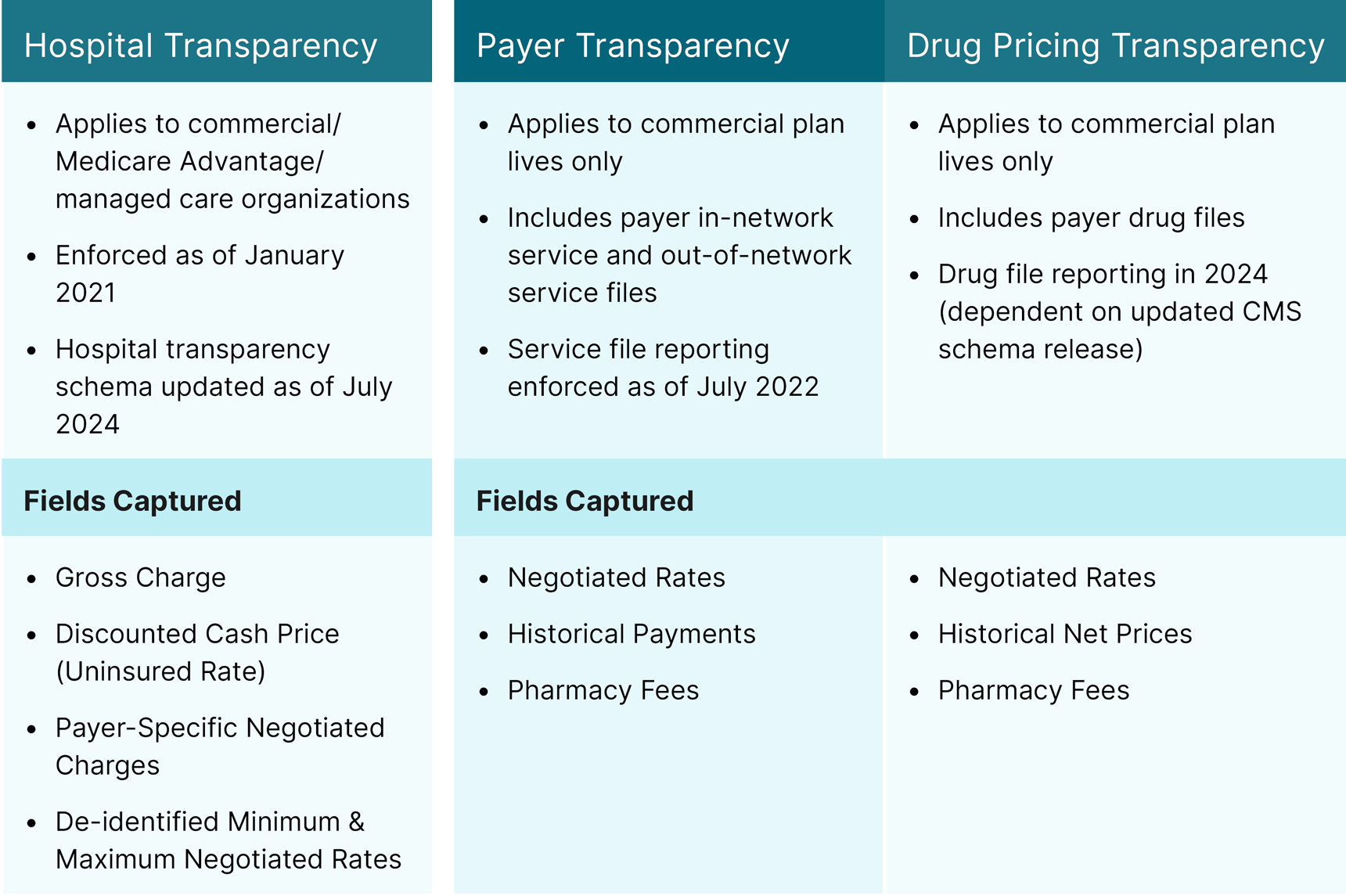

In 2020, the U.S. Department of Health and Human Services, Department of Labor, and Department of the Treasury published the Transparency in Coverage final rule, which requires hospitals and group health plans/insurance issuers offering coverage in individual and group markets to make specific healthcare price information publicly available via comprehensive machine-readable files (MRFs). The rule was established to:

The rule requires reporting of:

While the availability of initial payer and hospital MRFs provided some data on negotiated drug rates and services, enforcement of the drug pricing file was temporarily delayed. CMS populated an initial schema of required fields and data attributes for the drug pricing file at the beginning of the Transparency in Coverage implementation, but this initial schema was removed prior to the enforcement delay. Currently, the initial schema is only available through the CMS GitHub for the Transparency in Coverage rule1, though CMS is expected to release a new one.

Until that new drug pricing file schema is released, three things remain unclear:

All of these create risk for both plan sponsors and manufacturers. Without clear guidance, supplemental analysis will likely be needed to extract meaningful implications and impact to payer, hospital, and manufacturer strategies. Manufacturers may need to make analytic investments to obtain value from the incoming data when it becomes available. Ahead of this, it’s likely that self-funded plans responsible for drug price reporting will pressure their pharmacy benefit manager partners to take on that role.

Guidehouse consultants have been tracking early drug pricing transparency files produced by such payers as Optum and Blue Cross Blue Shield of Texas using the initial schema, and we expect other payers to follow suit when more guidance is available.

Currently available hospital and payer data files are already providing insights into how payer access and reimbursement structure changes may affect providers’ financial health and contracting priorities, including net-cost recovery considerations. They can also reveal under-prescribing patterns that could indicate which products might be afforded better payer reimbursement rates. Accurate assessment of this public data can help manufacturers better understand their positioning and impact on providers relative to competition.

Once drug price transparency data files are released on a wide scale, they will have the potential to immediately affect access positioning, launch strategy, and drug pricing strategy for pharmaceutical products in the commercial book of business. Availability of this data may affect manufacturer and payer contractual relationships, especially ahead of commercial product launches in competitive situations.

For manufacturers, this may mean that increased pressure is placed on contracting and rebate negotiations across therapeutic areas—especially in crowded markets with minimal clinical differentiation or entrenched incumbent competitors. Despite the current reporting requirement ambiguity, the data may give payers a deeper understanding of historical net pricing strategies by key manufacturer partners relative to other peer payer organizations—providing them with greater leverage in contract negotiations.

With broader use of price transparency data in the long-term, both manufacturers and health plans may face additional media attention, employer and consumer price shopping, and scrutiny surrounding pricing.

To adequately prepare for potential competitive scenarios as the transparency landscape evolves, drug manufacturers should consider:

Drug price transparency could have expansive cross-functional implications for pharmaceutical stakeholders. That’s why it’s crucial for manufacturers to understand how to use the ensuing data to make appropriate infrastructure investments, manage risk, and optimize their portfolio to outmaneuver the competition.

Our team has deep experience with dissecting and interpreting hospital and payer transparency files. Applying that expertise and our analytic capabilities to clients’ contracting, pricing, and launch strategies, we help them navigate hospital and payer data and determine risks and opportunities for key accounts by understanding customer net-cost recovery as well as average sales price implications.

As the policy landscape evolves, we continue to closely monitor price transparency guidance from CMS and other entities—generating actionable strategies for clients to adapt, position their portfolios, and launch assets ahead of the competition in a dynamic data environment.

1. CMSgov. 2022. “GitHub - CMSgov/Price-Transparency-Guide: The Technical Implementation Guide for the Tri-Departmental Price Transparency Rule.” GitHub. March 2, 2022. https://github.com/CMSgov/price-transparency-guide

Guidehouse is a global advisory, technology, and managed services firm delivering value to commercial businesses and federal, state, and local governments. Serving industries focused on communities, energy, infrastructure, healthcare, financial services, defense, and national security, Guidehouse positions clients for AI-led innovation, efficiency, and resilience.